Analysis: Here’s How Much Stock in Every NFL Team Would Trade for if They Were Public Companies

NFL fans are some of the most loyal, supportive fans out there, and they show their support with their wallets, paying for tickets to games, buying merch, subscribing to TV packages to watch NFL games, and more.

Many football fans are heavily invested in their team, and they want to see their team succeed. When a team does well, the fans are happy.

But what if you could get more for your investment than just entertainment? What if you could actually benefit financially from your team’s growth and success?

An NFL franchise is a valuable asset. The average NFL team is now worth $4.47 billion, and the most valuable team, the Dallas Cowboys, are worth an estimated $8 billion, according to newly released data from Forbes. That means the typical NFL team has a value that rivals publicly traded companies like Macy’s, Ubisoft, Mazda, New York Times, and AMC Entertainment.

That got us thinking — what if you could actually buy and trade stock in NFL franchises just like you can with publicly traded companies?

And yes, we realize that Green Bay Packers fans can already buy “stock” in the team, but that’s more of a symbolic gesture than anything else. The shares don’t come with any equity, there are no dividends, and you can’t trade them on the open market.

But what if there was an NFL stock exchange where you could buy and sell shares of your favorite team? That would be pretty cool, right?

We decided to take an educated guess at what an NFL stock exchange might look like.

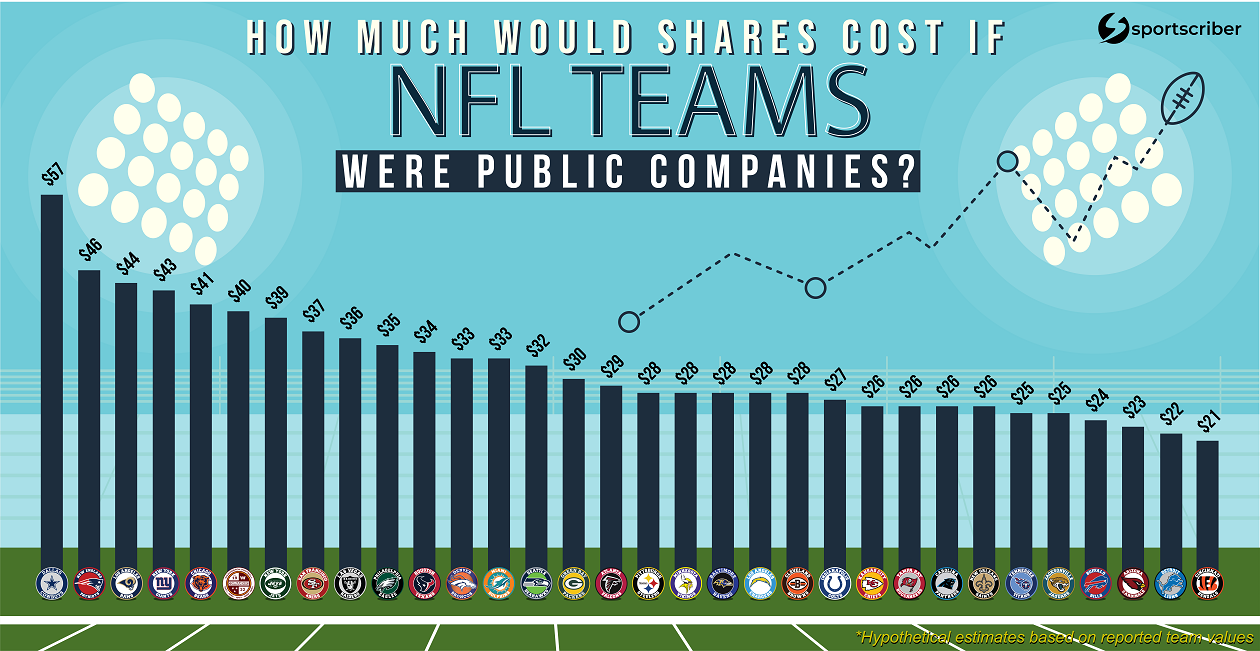

The Estimated Stock Price of Each NFL Franchise

We looked at the current value of each NFL franchise, factored in the estimated number of shares a franchise would offer by looking at the average volume of shares offered by public companies of similar sizes, and calculated a hypothetical stock price for each team.

The graph below shows our findings.

Here are the results laid out in a table format.

| Team | Value/Market Cap | Estimated Share Price |

| Dallas Cowboys | $8,000,000,000 | $57 |

| New England Patriots | $6,400,000,000 | $46 |

| Los Angeles Rams | $6,200,000,000 | $44 |

| New York Giants | $6,000,000,000 | $43 |

| Chicago Bears | $5,800,000,000 | $41 |

| Washington Commanders | $5,600,000,000 | $40 |

| New York Jets | $5,400,000,000 | $39 |

| San Francisco 49ers | $5,200,000,000 | $37 |

| Las Vegas Raiders | $5,100,000,000 | $36 |

| Philadelphia Eagles | $4,900,000,000 | $35 |

| Houston Texans | $4,700,000,000 | $34 |

| Denver Broncos | $4,650,000,000 | $33 |

| Miami Dolphins | $4,600,000,000 | $33 |

| Seattle Seahawks | $4,500,000,000 | $32 |

| Green Bay Packers | $4,250,000,000 | $30 |

| Atlanta Falcons | $4,000,000,000 | $29 |

| Pittsburgh Steelers | $3,975,000,000 | $28 |

| Minnesota Vikings | $3,925,000,000 | $28 |

| Baltimore Ravens | $3,900,000,000 | $28 |

| Los Angeles Chargers | $3,875,000,000 | $28 |

| Cleveland Browns | $3,850,000,000 | $28 |

| Indianapolis Colts | $3,800,000,000 | $27 |

| Kansas City Chiefs | $3,700,000,000 | $26 |

| Tampa Bay Buccaneers | $3,675,000,000 | $26 |

| Carolina Panthers | $3,600,000,000 | $26 |

| New Orleans Saints | $3,575,000,000 | $26 |

| Tennessee Titans | $3,500,000,000 | $25 |

| Jacksonville Jaguars | $3,475,000,000 | $25 |

| Buffalo Bills | $3,400,000,000 | $24 |

| Arizona Cardinals | $3,270,000,000 | $23 |

| Detroit Lions | $3,050,000,000 | $22 |

| Cincinnati Bengals | $3,000,000,000 | $21 |

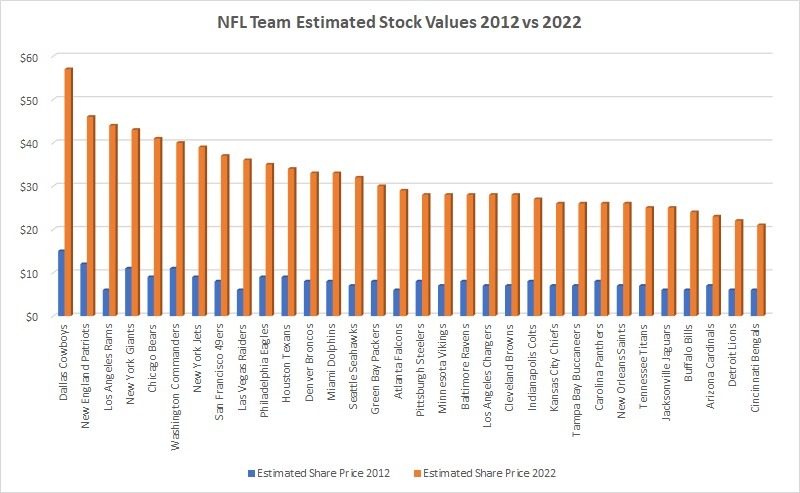

What if You Invested 10 Years Ago?

We also thought it would be fun for this thought exercise to estimate how much stock prices for all 32 NFL teams would have changed from 2012 to 2022 based on team values at the time. Just 10 years ago, the average NFL franchise was worth just over $1.1 billion, meaning teams are worth 4 times more on average today.

The chart below shows each franchise’s change in hypothetical stock price from 2012 to 2022.

The table below offers a full breakdown:

| Team | Value/Market Cap 2012 | Estimated Share Price 2012 | Value/Market Cap 2022 |

Estimated Share Price 2022

|

| Dallas Cowboys | $2,100,000,000 | $15 | $8,000,000,000 | $57 |

| New England Patriots | $1,640,000,000 | $12 | $6,400,000,000 | $46 |

| Los Angeles Rams | $780,000,000 | $6 | $6,200,000,000 | $44 |

| New York Giants | $1,470,000,000 | $11 | $6,000,000,000 | $43 |

| Chicago Bears | $1,190,000,000 | $9 | $5,800,000,000 | $41 |

| Washington Commanders | $1,600,000,000 | $11 | $5,600,000,000 | $40 |

| New York Jets | $1,280,000,000 | $9 | $5,400,000,000 | $39 |

| San Francisco 49ers | $1,180,000,000 | $8 | $5,200,000,000 | $37 |

| Las Vegas Raiders | $785,000,000 | $6 | $5,100,000,000 | $36 |

| Philadelphia Eagles | $1,260,000,000 | $9 | $4,900,000,000 | $35 |

| Houston Texans | $1,310,000,000 | $9 | $4,700,000,000 | $34 |

| Denver Broncos | $1,130,000,000 | $8 | $4,650,000,000 | $33 |

| Miami Dolphins | $1,060,000,000 | $8 | $4,600,000,000 | $33 |

| Seattle Seahawks | $1,040,000,000 | $7 | $4,500,000,000 | $32 |

| Green Bay Packers | $1,160,000,000 | $8 | $4,250,000,000 | $30 |

| Atlanta Falcons | $837,000,000 | $6 | $4,000,000,000 | $29 |

| Pittsburgh Steelers | $1,100,000,000 | $8 | $3,975,000,000 | $28 |

| Minnesota Vikings | $975,000,000 | $7 | $3,925,000,000 | $28 |

| Baltimore Ravens | $1,160,000,000 | $8 | $3,900,000,000 | $28 |

| Los Angeles Chargers | $936,000,000 | $7 | $3,875,000,000 | $28 |

| Cleveland Browns | $987,000,000 | $7 | $3,850,000,000 | $28 |

| Indianapolis Colts | $1,150,000,000 | $8 | $3,800,000,000 | $27 |

| Kansas City Chiefs | $1,010,000,000 | $7 | $3,700,000,000 | $26 |

| Tampa Bay Buccaneers | $1,030,000,000 | $7 | $3,675,000,000 | $26 |

| Carolina Panthers | $1,050,000,000 | $8 | $3,600,000,000 | $26 |

| New Orleans Saints | $971,000,000 | $7 | $3,575,000,000 | $26 |

| Tennessee Titans | $1,010,000,000 | $7 | $3,500,000,000 | $25 |

| Jacksonville Jaguars | $770,000,000 | $6 | $3,475,000,000 | $25 |

| Buffalo Bills | $805,000,000 | $6 | $3,400,000,000 | $24 |

| Arizona Cardinals | $922,000,000 | $7 | $3,270,000,000 | $23 |

| Detroit Lions | $855,000,000 | $6 | $3,050,000,000 | $22 |

| Cincinnati Bengals | $871,000,000 | $6 | $3,000,000,000 | $21 |

Our Methodology

To calculate hypothetical stock prices for NFL franchises if they became publicly traded companies we first looked at the value of each franchise according to Forbes August 2022 report. We then looked at a random selection of 20 public companies that have a market cap of around $4.47 billion (the average value of an NFL team) and took an average of their total shares outstanding — 140,000,000. With this information, we could then divide each team’s value by 140,000,000 shares to come up with their estimated stock price if they were to go public.